UX/UI Design

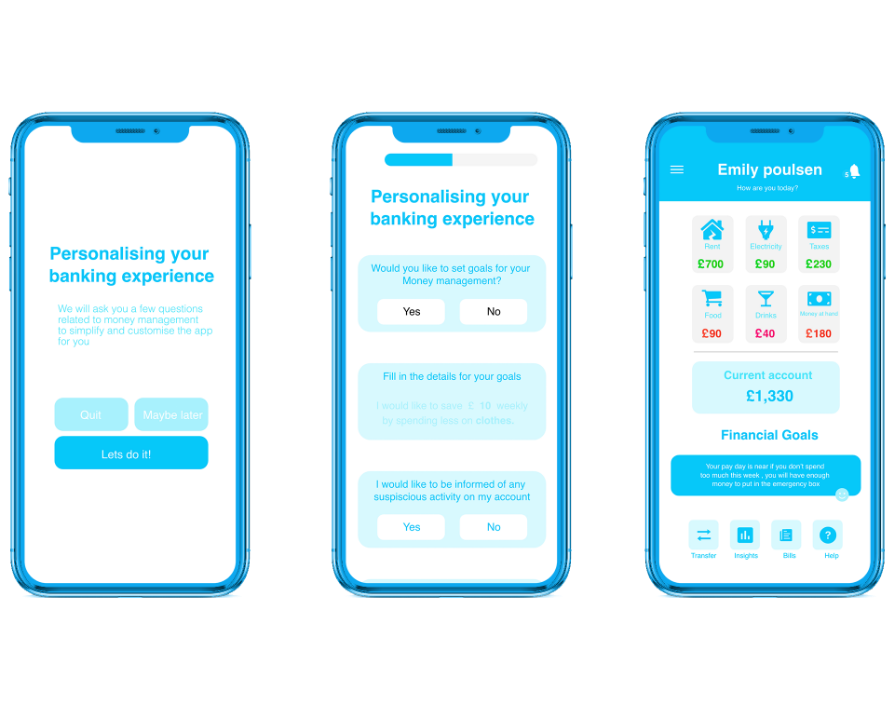

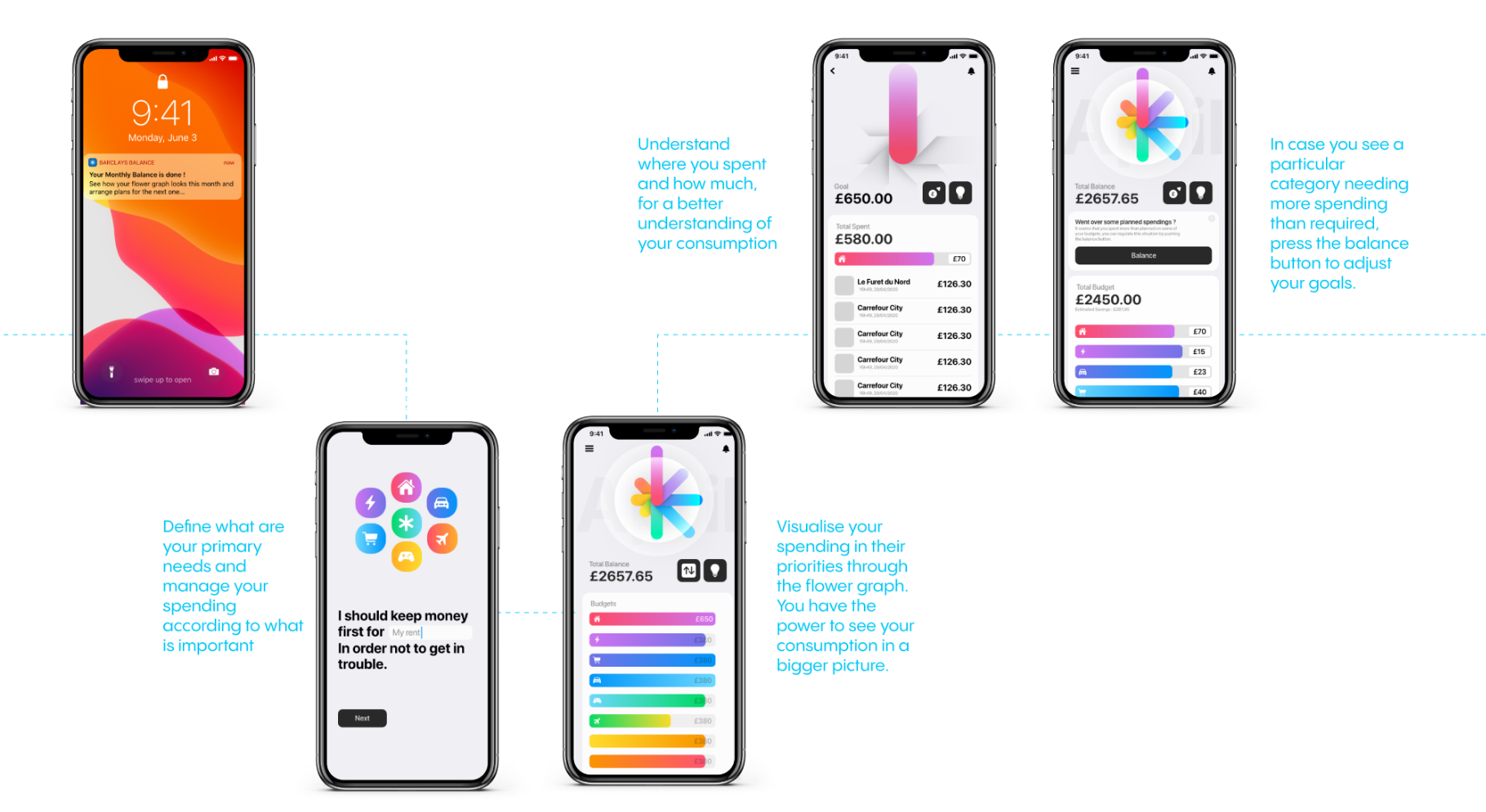

Barclays Balance

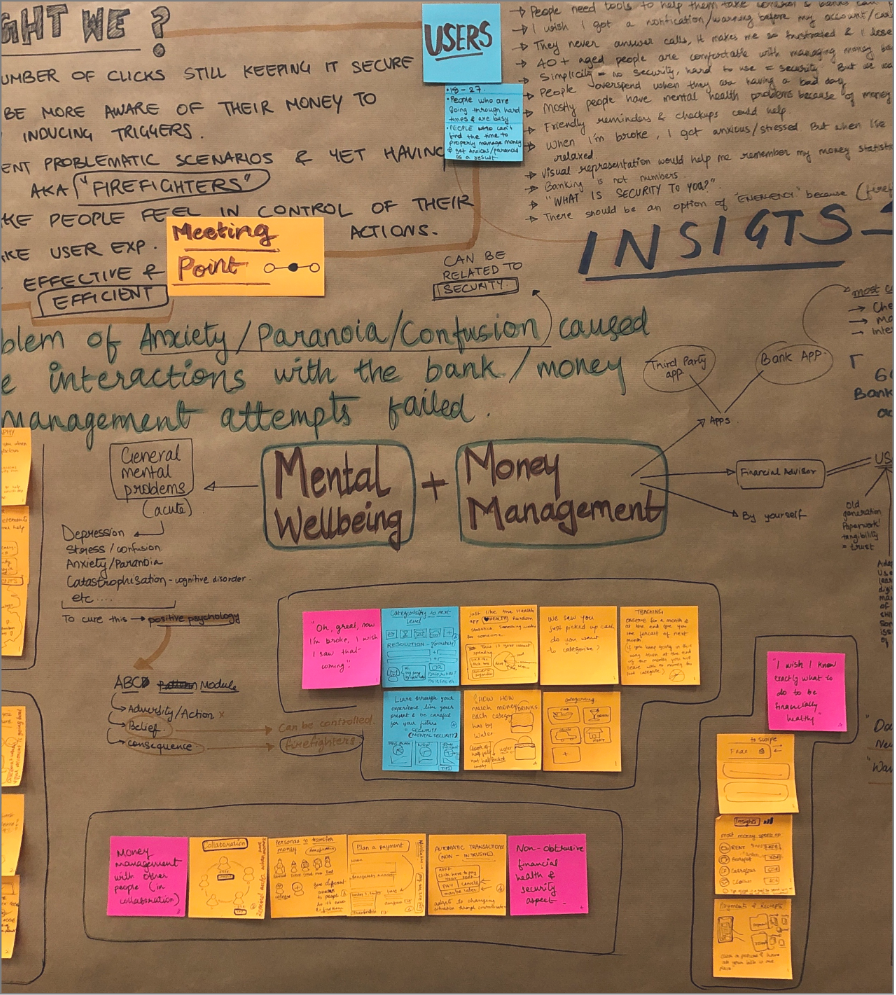

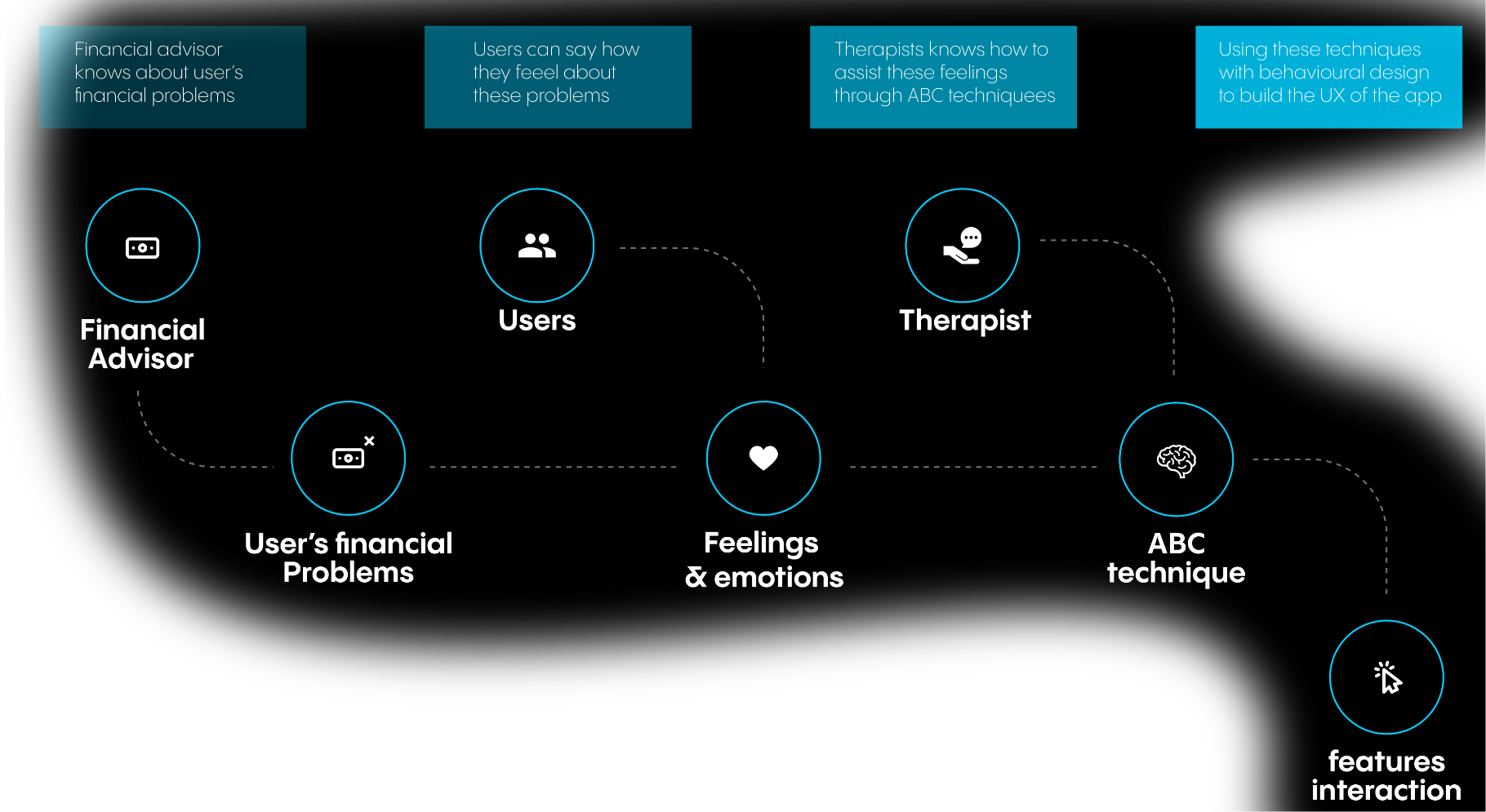

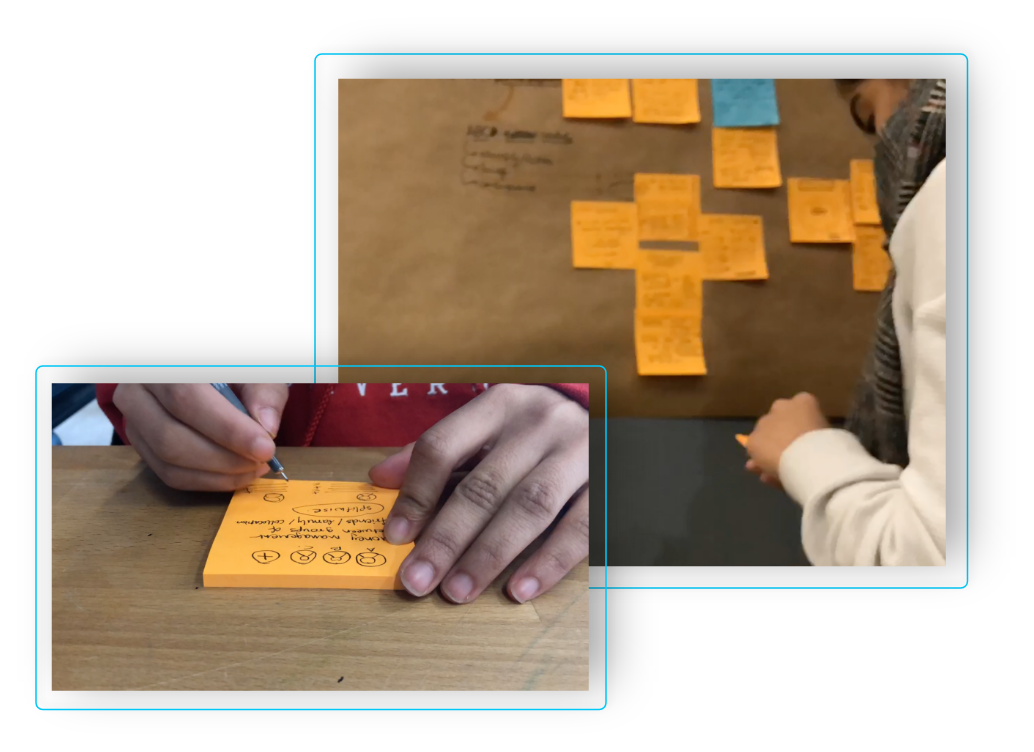

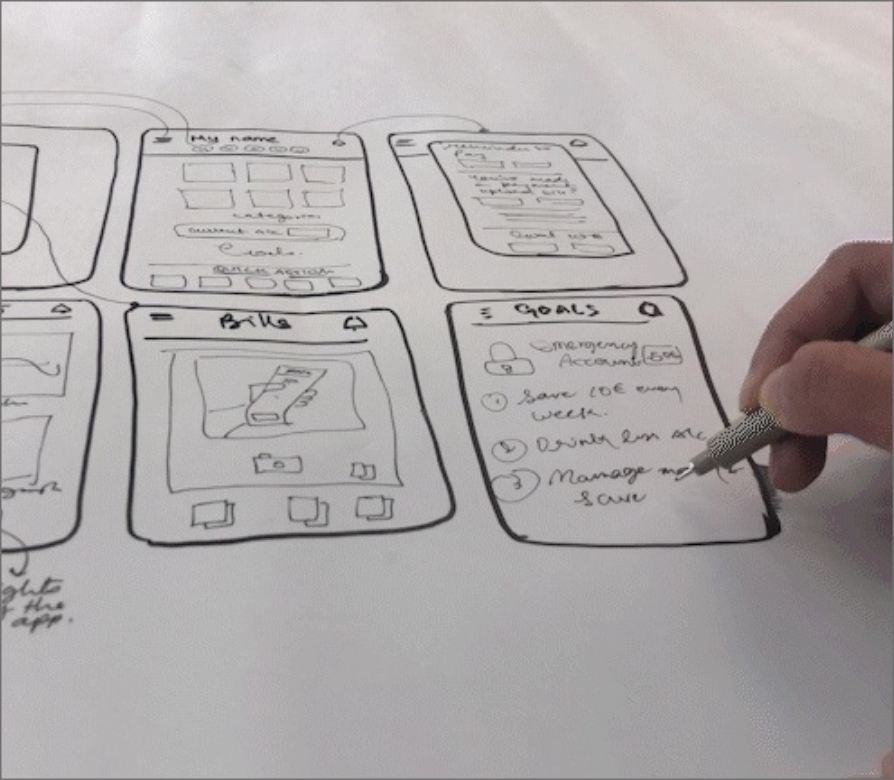

To challenge myself for the 2 week sprint, I selected a complex brief “How to bridge the gap between money and mental health” (Brief by Barclays from D&AD).